Provides coverage for a specified term, such as 10, 20, or 30 years. If you pass away within the term, your beneficiaries receive a death benefit

This policy offers permanent life insurance with flexible premium payments and a death benefit, alongside a tax deferred cash

Essentially a whole life policy, the death benefit is designed to cover funeral costs, medical bills, and other end-of-life expenses

These policies offer permanent coverage with fixed premiums, a guaranteed death benefit, and a cash value component that grows over time.

Complete our quick questionnaire so we understand your goals

We’ll compare multiple carriers and design a plan that fits your life

There’s no cost or obligation to enjoy a simple, stress‑free process from start to finish

We put your family’s protection at the center of everything we do. Our agents listen to your story and deliver the solution that makes sense for you.

Whether you’re in a big city or a small town, Eterna offers flexible options and agents nationwide so you never feel limited.

Life insurance doesn’t have to be complicated. We streamline the process and speak your language.

With a 4.9/5 average rating and access to 30+ A‑rated carriers, we deliver ethical service you can trust.

An Indexed Universal Life (IUL) policy combines a death benefit with a cash value account, similar to traditional universal life insurance. However, the cash value of an IUL grows based on the performance of a stock index, such as the S&P 500, rather than earning a fixed interest rate. Like universal life policies, IULs offer flexibility, allowing you to adjust your premium as your cash value grows. Over time, your cash value could potentially cover your premiums, resulting in a zero-cost policy

Requesting a free, no-obligation life insurance quote through GO-eterna is faster and easier than ever! Our patented process offers you the chance to get a high face amount of coverage FAST and our rates are among the best in the industry.

Through GO-eterna, you can get quality life coverage for less. Save up to 70% on your policy compared to the same coverage through other carriers. You can get a personalized, free quote in just a few minutes. It's that easy to start helping protect your family's financial future!

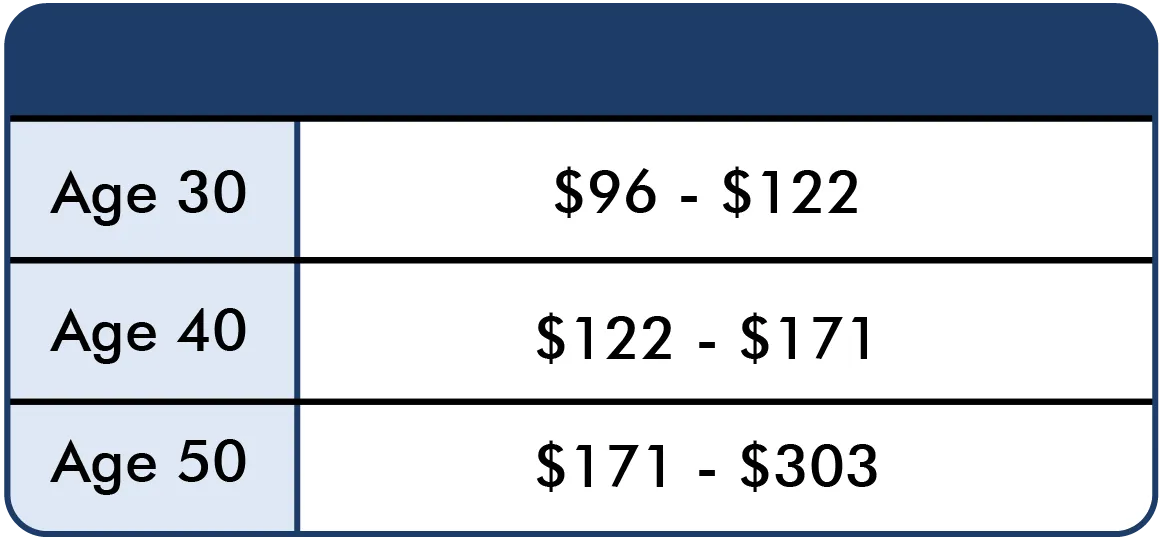

Note: Premiums are not guaranteed and will vary based on coverage need, geographic location, health, and other factors.

If you are not completely satisfied with your term life insurance policy, you may cancel at any time within the 30-day money back period and receive a full refund.

Quotes are provided for informational purposes and do not constitute an offer of insurance. Fidelity Life Association is licensed in all states and the District of Columbia, except NY and WY. A two-year suicide exclusion and contestability period may apply (one year in some states). All applications are subject to underwriting approval. NAIC number is 63290.

Like most insurance policies, Fidelity Life's policies contain exclusions, limitations, reductions of benefits and terms for keeping them in force. For complete costs and details, contact your Fidelity Life Representative.

Invitations for application for life insurance on Quotes.FidelityLife.com are made through designated agent, Michael Bowcock, only where licensed and appointed. License numbers are available upon request and are automatically provided where required by law. Michael Bowcock is a licensed life insurance agent in all 50 states, including the District of Columbia, and his resident state of Illinois. Michael Bowcock’s Illinois license number is 11736943; in California, 0G99555; in Louisiana, 589562; in Minnesota, 40333060; in Utah, 445133; in Massachusetts, 1884080; and in Texas, 1617308. Efinancial, LLC’s California license number (d/b/a Efinancial Term Insurance Services) is 0F37537; in Louisiana, 323680 and in Utah, 104501. Rates and time taken to purchase a policy vary by product.